loading

loading

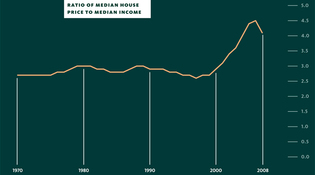

They called him “Mr. Bubble.” Mark Zurolo ’01MFAThe graph above shows the relationship between housing prices and income even more clearly. When you divide median home price by median household income, the result is a ratio that remained fairly steady from 1970 to 2000. Then -- with the boom in the housing market -- it took off. View full imageOf course, any of these new markets would be subject to the same human irrationalities and imperfections that created the current mess -- and that Shiller has spent his career identifying. So along with more and more markets, Shiller also wants more and better regulation. He is particularly drawn to the notion of a Financial Products Safety Commission, which the Obama administration recently proposed. Its charge would be to look out for consumers, day by day and new product by new product, in a way that a static regulation never could. One reasonable critique of Shiller's ideas is that they may work better on paper than in practice (much like the elegant theories of neo-classical economics). The New Yorker, in reviewing The New Financial Order, wrote: “There is a mad-scientist quality to some of these proposals, and the technical and political obstacles to their implementation seem insurmountable.” Shiller has experienced some of these obstacles. In 2006, a company he owns, called MacroMarkets, created a market for real estate futures contracts on the Chicago Mercantile Exchange. They have not been very popular. Shiller acknowledges this, but he has pressed on. In June, MacroMarkets created the first real estate securities -- which would allow investors to short housing prices. He hopes that he has begun laying the groundwork for a less risky, less bubble-prone economy of the future. Of all his policy ideas, the broadest is one that he calls the “Rising Tide Tax System.” Developed with Len Burman, a Syracuse University economist who spent years in Washington, it is essentially a form of inequality insurance. Under such a system, tax rates would automatically adjust along with levels of income inequality. If the incomes of the middle class and the poor were growing at a faster pace than the incomes of the rich -- as happened during the 1950s and ’60s -- tax rates on the rich would fall. But if the incomes of the rich were growing the fastest -- as has happened over most of the last 35 years -- their tax rates would rise. The opposite, in fact, has happened in recent years. The wealthy have received both the largest pretax raises and the largest tax cuts. The middle class and poor have not done nearly so well. That combination, Shiller worries, has created disaffection. And the disaffection has made it harder for policy makers to take steps, such as removing trade barriers, that would lift the economy and enlarge the nation's economic pie. The inequality tax would have the potential to cure this disaffection. It would allow Washington to promise voters that they would be not be denied a fair share of the nation's economic bounty. If large economic forces caused middle-class incomes to stagnate, tax policy would help out -- not erasing the effect of those forces but at least ameliorating them, Shiller says. The tax idea connects directly to Shiller's conception of how an economy works. The Rising Tide Tax System is meant to make people feel that the economy is fair, that they can trust the institutions around them, that they can have the confidence to take risks that, in the end, will benefit the larger economy. “I think these are exciting ideas,” Shiller says. “But they're not going anywhere.” “Maybe someday,” he adds. You can take that as the lament of an academic who realizes his ideas are never likely to spread beyond the ivory tower. Or you can take it as the musings of a man who has known what it's like to be ahead of his time.

The comment period has expired.

|

|