loading

loading

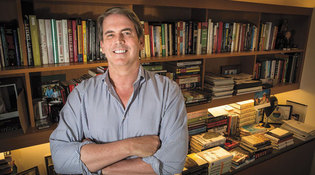

Where They Are NowLife and money managementMoney manager Scott Bessent ’84 on failure, choosing a major, and how finance is like journalism.  Julie BrownWhen Scott Bessent ’84 decided on a career in the world of finance, one key factor was the office sofa. View full imageScott Bessent ’84 currently serves as chief investment officer of Soros Fund Management, a $30 billion family office. After graduation, Bessent went to work at Brown Brothers Harriman, then did stints at Kynikos Associates, the Soros Fund, Protégé Partners, and others before George Soros recruited him as CIO in 2011. In August, Bessent announced that he will leave at the end of the year—with a $2 billion allocation from Soros to start his own hedge fund. Y: You were going to be a journalist when I knew you at Yale. What happened?B: Well, I had run to be editor of the Yale Daily News, and I didn’t get it. I kind of locked myself in my room for a month, and just went to class and the dining hall. The following semester, I thought, maybe I should consider doing something else going forward. I went over to the Career Center and saw that Jim Rogers ’64, a well-known money manager in New York City, was looking for an intern. And he even offered—which was key for me—a place to stay on the office sofa. Y: What did you like about the job?B: A lot of what you do is the same kind of research you do in journalism. My approach is to start with an abstract concept and then look at the empirical data, as a good journalist would do. Y: What did you major in, and what would you advise for undergrads who want to follow in your footsteps?B: I kept switching; I went from computer science to art history and finally landed on political science, but if I were able to do it all over again, I would choose to double major in psychology and philosophy. I think the main thing now in markets is to be able to analyze data and behavior; and philosophy gives one [the] big-picture perspective. Y: You have taught several residential college seminars at Yale over the years. Were the classes made up of economics and math majors?B: I’ve taught three classes at Yale: Twentieth Century Financial Booms and Busts; Hedge Funds: History, Theory and Practice; and my favorite, about the financial panic of 2007 to 2009. I was teaching it in real time, so the kids were trying to figure out what was going on, which made it exciting. Half of the students were economics majors, but the other half was more eclectic. A woman who was an art history major got the second-highest grade in the hedge funds class. Y: You had a setback when you started your own fund in 2000 only to close it down in 2005. I’m sure most of our classmates have failed at one thing or another by now. What was the key to bouncing back?B: What I really learned was that I shouldn’t change my style or the construct of my firm because of investor preferences. It was a great lesson for me. I’m friends with quite a few Silicon Valley billionaires, and I’m amazed at how many things they’ve failed at. Pick yourself up and go on to the next thing. This time around, I’m starting my fund with a small group of investors who are also my partners, and on my terms. Y: You and your husband married in 2011 and have two small children. What effect, if any, will the Supreme Court decision making gay marriage legal have on you?B: In a certain geographic region at a certain economic level, being gay is not an issue. What’s fantastic is now, people in the rest of America, whether blue collar or white collar, have access to everything. If you had told me in 1984, when we graduated, and people were dying of AIDS, that 30 years later I’d be legally married and we would have two children via surrogacy, I wouldn’t have believed you.

The comment period has expired.

|

|