loading

loading

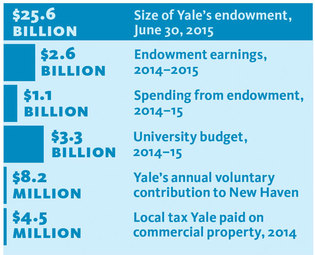

Light & VerityConnecticut eyes tax revenue from YaleBills to tax the endowment and Yale property were proposed, then scuttled.  View full imageConnecticut state legislators, thirsty for revenue in a budget crisis, introduced two bills this year with the aim of collecting more taxes from Yale for the state and New Haven. One would have levied a tax on returns on the university’s $25.5 billion endowment; the other would have added some Yale facilities that are not now taxed to the property-tax rolls, providing they produce more than $6,000 a year in revenue. Neither bill passed, but local support for them exposed cracks in a city-university relationship that has been friendly for the past two decades. The bills’ supporters contended that a financially flush Yale should contribute more when the state struggles. Yale countered that it is already a generous neighbor, and that its tax-free status has allowed the university to become an economic engine for New Haven. The endowment-tax bill would have imposed a 7.5 percent tax on unspent endowment earnings above inflation—but only for endowments of $10 billion or more (effectively, only for Yale). Representative Toni Walker of New Haven said taxing Yale’s unspent earnings would yield $78 million a year, roughly half of the proposed state cuts to public higher education. But the bill was effectively killed in committee after a spokesman for Governor Dannel Malloy announced in March that the governor “values Yale” and doesn’t believe new taxes are a solution. Returns on Yale’s endowment in the last fiscal year totaled $2.6 billion, but the university limits endowment spending to 5.25 percent of the fund’s total value. So while the endowment provided $1.1 billion of Yale’s operating revenues (about a third of the university’s budget) last year, another $1.5 billion in endowment income was reinvested. Richard Jacob, Yale’s associate vice president for federal and state relations, testified in a hearing on the bill that Yale makes an $8.2 million voluntary payment to New Haven yearly, offers incentives for its employees to buy homes in the city, and has revitalized the region’s economy by luring 60 new companies and $1 billion in venture capital. New Haven mayor Toni Harp ’78MEnvD took no position on the endowment bill, but favored SB 414, which sought to clarify which Yale properties are subject to local property taxes. Under a 182-year-old state law, academic property of Yale and three other institutions are exempt from taxes, but commercial properties that produce more than $6,000 a year in for-profit business revenue are taxable. Yale already pays property taxes on retail space—and some residential property—that it rents out; its annual bill in New Haven is $4.5 million. In a press conference, Yale president Peter Salovey ’86PhD and vice president Bruce Alexander ’65 argued that SB 414 would tax buildings Yale has always considered academic properties—such as buildings where scientific research results in later commercial applications. Such taxes would “harm New Haven’s ability to grow its economy,” Salovey said. Supporters of the bill said it would merely clarify when a building with both nonprofit and for-profit uses should be taxed. (For instance, Yale’s Center for Genome Analysis does gene-sequencing work for private companies as well as Yale researchers.) Right now, the supporters said, the city has to rely on Yale’s own judgment about which properties are tax-exempt. SB 414 was also eventually killed after making it out of the senate’s finance committee. Malloy suggested that he would commission a study of whether some Yale research facilities should be taxed, looking specifically at how California and Massachusetts deal with such facilities at Stanford and MIT.

The comment period has expired.

|

|