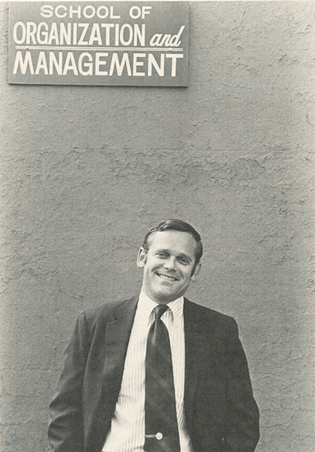

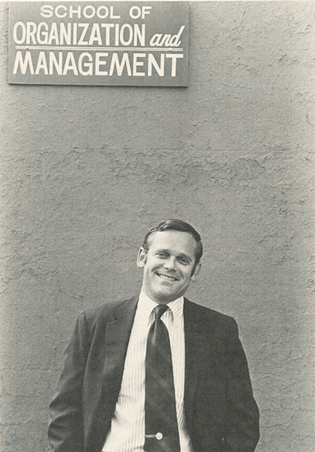

William Donaldson ’53 in a Yale Alumni Magazine photo after his appointment as founding dean of the School of Management in 1975.

View full image

To find the embodiment of the Yale School of Management’s mission to train leaders in both the private and the public sectors, look no further than the school’s founding dean. William Donaldson ’53, who died on June 12 at age 93, made his mark in investment banking, government, and academia over a long and varied career.

Donaldson, whose father was a Yale-educated engineer and businessman, grew up in Buffalo, New York. He majored in American studies at Yale and was tapped for Skull and Bones. After college, he joined the Marine Corps, then worked for the banking firm of G. H. Walker & Co. before enrolling at Harvard Business School, where he earned his MBA.

In 1959, he and two of his fellow HBS graduates founded Donaldson, Lufkin & Jenrette, a securities firm that pioneered a new approach targeting institutional investors and emphasizing research. From an initial equity investment of $100,000, DLJ grew to a firm with assets of $288 million by the time Donaldson left the firm in 1973. A 2001 article in Institutional Investor declared that “DLJ effectively transformed a genteel Wall Street club, in which information consisted of whispered confidences, into a marketplace of ideas.” DLJ also distinguished itself by becoming the first securities firm to sell its shares to the public.

After leaving DLJ, Donaldson worked briefly in government, first as an undersecretary of state to Henry Kissinger and then as counsel to vice president Nelson Rockefeller. Then, in 1975, when Yale was about to launch the professional school then known as the School of Organization and Management, President Kingman Brewster Jr. ’41 offered Donaldson the deanship. A Yale trustee at the time, Donaldson stepped down from the board to take the job. “I’d seen firsthand the gaps in knowledge, understanding, and respect that existed between people in business and people in public-sector leadership,” he later wrote in a memoir. “To tackle the problem, we built a faculty with deep experience as leaders and thinkers in all three sectors—for-profit, nonprofit, and government.”

Donaldson left the deanship in 1980 and returned to Wall Street. But he would be called on again and again in the coming years to lead institutions, sometimes troubled ones. From 1991 to 1995, he was chairman and CEO of the New York Stock Exchange. In 2000, he became CEO of the insurance company Aetna and spent a year turning it around. And in 2003, when the financial world had been rocked by the Enron scandal, President George W. Bush ’68 tapped him to become the chair of the Securities and Exchange Commission, where he stepped up enforcement actions and called for corporate accountability.

Donaldson’s time in the Yale administration was relatively short, but his ties to the School of Management and to his undergraduate class remained strong. SOM’s award for alumni who “embody the school’s mission to educate leaders for business and society” is called the Donaldson Fellows program in his honor. His official obituary says he almost never missed a Yale reunion—and those lucky enough to be in the Class of 1953 got a glimpse of a talent one might not expect from a Wall Street Master of the Universe. The ’53 50th reunion report includes the news that the class was treated to “an unforgettable yodeling performance by the incomparable Bill Donaldson.”

loading

loading